ICD Research’s ‘Global CEO Business Outlook Survey 2011–2012’ reveals insights into the CEO business.

After conducting extensive research, full-service global market agency ICD Research recently published a definitive panel-report analysis of industry outlook, exploring how opportunities and demand will change as companies emerge from the recession.

Drawn from an exclusive panel of C-level respondents from leading international companies, this report grants access to the opinions and strategies of top business decision-makers and competitors, and examines their actions surrounding business priorities. Focusing on key areas such as revenue growth expectations, M&As and leading business concerns, the survey, rigorously compiled using ICD's three-stage methodology, reveals how:

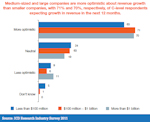

- 63% of C-level respondents are optimistic about revenue growth for their company over the next 12 months compared with the previous 12 months

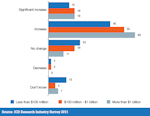

- global industry executives expect to see increased levels of consolidation, with 61% of respondents predicting an increase in M&A activity over the next 12 months

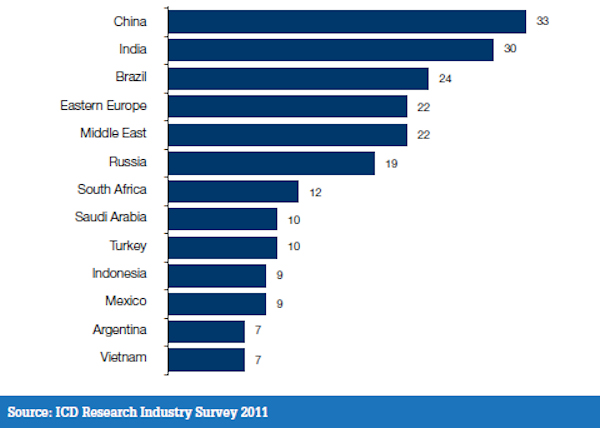

- China will be the most important region for growth among emerging markets, along with India and Brazil

- market uncertainty, responding to pricing pressure and cost containment, is the most immediate business concern for the global industry

- average marketing budgets are expected to rise by 10% in 2011 compared with 2010

- market intelligence research, client acquisition solutions, business performance management solutions and CRM solutions emerged as the most important areas of investment among marketing and sales solutions activities in 2011.

Self examination

As the survey results indicate, executives from all industries expect to see increased levels of M&A activity; for example, attempts to reduce operational costs and increase organisational efficiencies are major factors in the rise in consolidation expectations.

Other factors to nurture a favourable M&A environment are improvements to the global economy and increasing current facilities to meet demand, which will be increasingly fulfilled by emerging economies. As a result, multinationals are viewing emerging economies as production locations and as major customer bases for future growth.

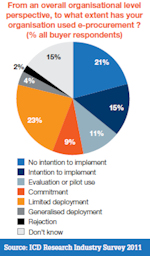

The top five emerging markets expected to offer most opportunities for industry growth are China, India, Brazil, the Middle East and Eastern Europe. China and India have become very attractive to foreign investors due to their strong economic growth. Domestic companies in China are competing with multinational companies whereas India plans to put more emphasis on PPP projects. And as online solutions become more advantageous to large and fragmented industries, there are several areas where e-procurement can help increase accountability and clarity in corporate spending to eventually reduce operational expenditure.

To get your full copy of the results, go to www.icd-research.com.

Figure 1. Medium-sized and large companies are more optimistic about revenue growth

than smaller companies.

Figure 1. Medium-sized and large companies are more optimistic about revenue growth

than smaller companies.

Figure 2. 82% of respondents from large companies expect an increase in M&As activity during the next 12 months.

Figure 2. 82% of respondents from large companies expect an increase in M&As activity during the next 12 months.

Figure 3. Which emerging markets do you expect to offer your industry the most growth over the next 12 months? (% all respondents).

Figure 3. Which emerging markets do you expect to offer your industry the most growth over the next 12 months? (% all respondents).